The term “Circular Debt” has become a haunting fixture in Pakistan’s economic lexicon. It represents a systemic failure where the inability of one entity to pay its dues triggers a chain reaction of defaults across the entire energy supply chain—from consumers to distribution companies (DISCOs), power producers (IPPs), and fuel suppliers.

As of late 2025 and entering 2026, the crisis remains the single largest threat to Pakistan’s fiscal stability, despite recent landmark restructuring efforts.

1. The Current State: By the Numbers (2025-2026)

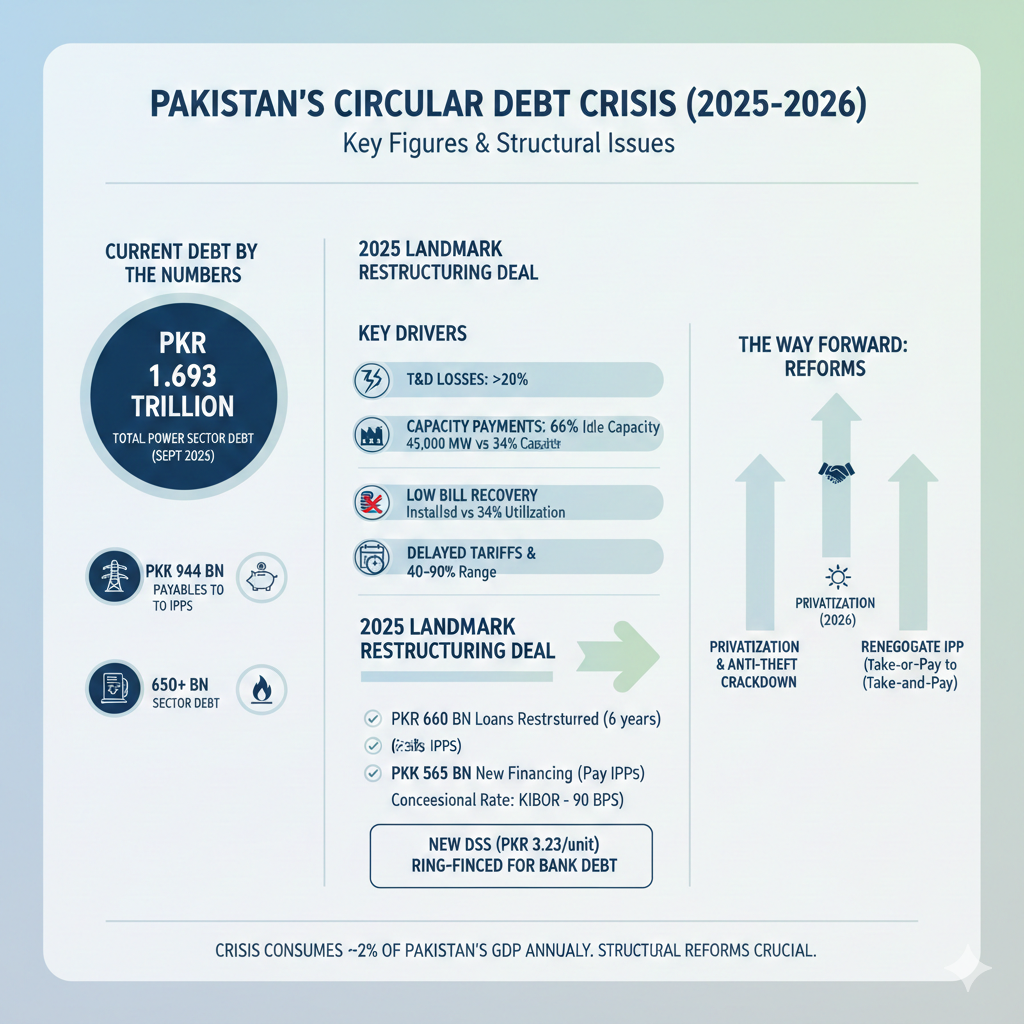

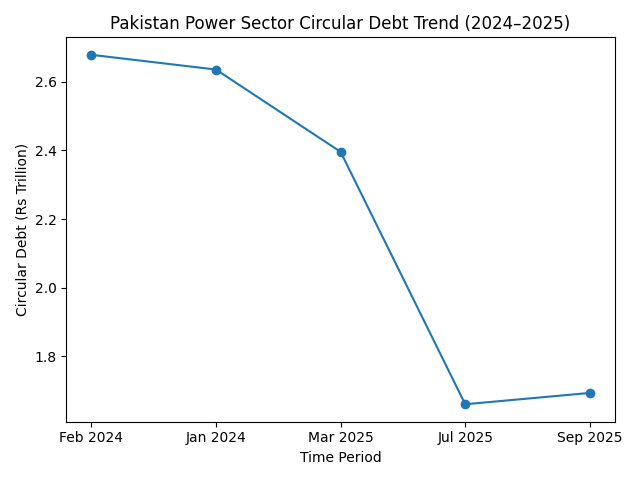

Following a historic PKR 1.225 trillion settlement and restructuring deal in late 2025, the stock of circular debt saw a significant technical reduction, though the underlying “flow” (new debt being added) persists.

- Total Circular Debt (Power Sector): Stood at approximately PKR 1.693 trillion as of September 2025, following a major stock clearance drive that reduced it from a peak of nearly PKR 2.4 trillion earlier in the year.

- Payables to Power Producers: Roughly PKR 944 billion (as of Q1 FY26).

- Amount Parked in Power Holding Limited (PHL): Approximately PKR 660 billion.

- Gas Sector Debt: An additional PKR 650 billion+ remains unresolved in the gas supply chain.

2. Key Drivers of the Crisis

The circular debt is not just a “payment issue”; it is a symptom of deep structural inefficiencies.

A. Transmission & Distribution (T&D) Losses

Pakistan’s aging grid suffers from massive technical losses and rampant electricity theft. In 2025, DISCOs reported losses exceeding 20% of total supplied power, far above the international benchmark of 5–8%.

B. Capacity Payments

A significant portion of the tariff goes toward “Capacity Charges”—payments made to IPPs to keep plants available, even if no electricity is generated. With over 45,000 MW of installed capacity but an average utilization of only 34%, consumers are essentially paying for idle power plants.

C. Low Bill Recovery

Recovery rates vary wildly across the country. While some DISCOs achieve 90%+, others in regions like Tribal Areas or parts of Sindh and Balochistan struggle to recover even 40-50% of billed amounts.

D. Delayed Tariffs and Subsidies

The gap between the cost of generation (notified by NEPRA) and the tariff charged to consumers (decided by the government) often remains unbridged, requiring subsidies that the government frequently fails to release on time.

The term “Circular Debt” has become a haunting fixture in Pakistan’s economic lexicon. It represents a systemic failure where the inability of one entity to pay its dues triggers a chain reaction of defaults across the entire energy supply chain—from consumers to distribution companies (DISCOs), power producers (IPPs), and fuel suppliers.

As of late 2025 and entering 2026, the crisis remains the single largest threat to Pakistan’s fiscal stability, despite recent landmark restructuring efforts.

- AIRTIGHT LIDS & 3 GRATER ATTACHMENTS:The airtight lids that come with this mixing bowl set make it easy to store ingredi…

- NON-SLIP SILICONE BOTTOMS: The rubber on the bottom of the mixing bowls is for gripping and staying put which prevents s…

- NESTING BOWLS & DISHWASHER SAFE: These kitchen serving bowls can be nested together and offer space-efficient storage in…

- Built to take it all on with the durable and built-to-last metal construction, and 59 touchpoints around the mixer bowl …

- 4.5 Quart Stainless Steel Bowl to mix up to 8 dozen cookies in a single batch. Dishwasher safe. Using the flat beater; 2…

- Easily add ingredients with the tilt-head design, because you’ll have better access to the bowl – lock the head in place…

- Generous Capacity: 7-quart slow cooker that comfortably serves 9+ people or fits a 7-pound roast

- Cooking Flexibility: High or low slow cooking settings, with convenient warm function for ideal serving temperature

- Convenient: Set it and forget it feature enables you to cook while at work or performing daily tasks

- PROFESSIONAL POWER: 1000 watts of professional power can crush ice and breakdown any tough ingredient.Power source : Cor…

- XL CAPACITY: The 72 oz professional blender pitcher is excellent for making frozen drinks and creamy smoothies for the e…

- INTELLIGENT TECHNOLOGY: Total Crushing Technology delivers unbeatable power with blades that pulverize and crush through…

- COOK, BAKE AND SERVE IN STYLE: This pink heart-shaped 2-quart enameled cast iron Dutch oven pot can do it all. Cook, bak…

- COOK LIKE A PRO: Crafted from durable cast iron that delivers superior heat retention and distribution for perfect resul…

- THAT’S SMOOTH: The smooth enamel interior minimizes sticking and provides the perfect base for searing. This Dutch oven …

1. The Current State: By the Numbers (2025-2026)

Following a historic PKR 1.225 trillion settlement and restructuring deal in late 2025, the stock of circular debt saw a significant technical reduction, though the underlying “flow” (new debt being added) persists.

- Total Circular Debt (Power Sector): Stood at approximately PKR 1.693 trillion as of September 2025, following a major stock clearance drive that reduced it from a peak of nearly PKR 2.4 trillion earlier in the year.

- Payables to Power Producers: Roughly PKR 944 billion (as of Q1 FY26).

- Amount Parked in Power Holding Limited (PHL): Approximately PKR 660 billion.

- Gas Sector Debt: An additional PKR 650 billion+ remains unresolved in the gas supply chain.

2. Key Drivers of the Crisis

The circular debt is not just a “payment issue”; it is a symptom of deep structural inefficiencies.

A. Transmission & Distribution (T&D) Losses

Pakistan’s aging grid suffers from massive technical losses and rampant electricity theft. In 2025, DISCOs reported losses exceeding 20% of total supplied power, far above the international benchmark of 5–8%.

B. Capacity Payments

A significant portion of the tariff goes toward “Capacity Charges”—payments made to IPPs to keep plants available, even if no electricity is generated. With over 45,000 MW of installed capacity but an average utilization of only 34%, consumers are essentially paying for idle power plants.

C. Low Bill Recovery

Recovery rates vary wildly across the country. While some DISCOs achieve 90%+, others in regions like Tribal Areas or parts of Sindh and Balochistan struggle to recover even 40-50% of billed amounts.

D. Delayed Tariffs and Subsidies

The gap between the cost of generation (notified by NEPRA) and the tariff charged to consumers (decided by the government) often remains unbridged, requiring subsidies that the government frequently fails to release on time.

3. The 2025 Landmark Restructuring Deal

In September 2025, the government, in collaboration with the Pakistan Banks Association (PBA), executed the largest financial transaction in the country’s history to address the debt stock.

- Restructuring: PKR 660 billion in existing loans were restructured over 6 years.

- Fresh Financing: PKR 565 billion in new loans were raised to pay off IPPs.

- Cost Reduction: Banks agreed to a concessional rate of KIBOR minus 90 basis points, saving the government billions in markup.

- The Surcharge: The existing PKR 3.23 per unit Debt Service Surcharge (DSS) is now being ring-fenced specifically to repay this bank debt rather than disappearing into the general budget.

4. The Way Forward: Privatization and Reform

To prevent the debt from ballooning back to 2024 levels, the government has accelerated reforms under IMF and World Bank mandates:

- Privatization of DISCOs: In early 2026, the government officially launched the privatization process for five major distribution companies to bring in private investment and reduce theft.

- Solarization and Anti-Theft: Aggressive crackdowns on “Kunda” (illegal) connections and a shift toward solar energy are aimed at reducing the burden on the national grid.

- Renegotiating IPP Contracts: The government continues to seek revisions to older Power Purchase Agreements (PPAs) to shift from “take-or-pay” to “take-and-pay” models.

Conclusion

Pakistan’s circular debt is a “leaking bucket.” While the 2025 restructuring fixed the “stock” of the debt, the “flow” can only be stopped by improving DISCO governance and modernizing the grid. Without these structural changes, the circular debt will continue to consume nearly 2% of Pakistan’s GDP annually.